With a focus on the health of the US economy, the data-driven research platform Game of Commerce warned of potentially serious consequences based on the performance of specific metrics.

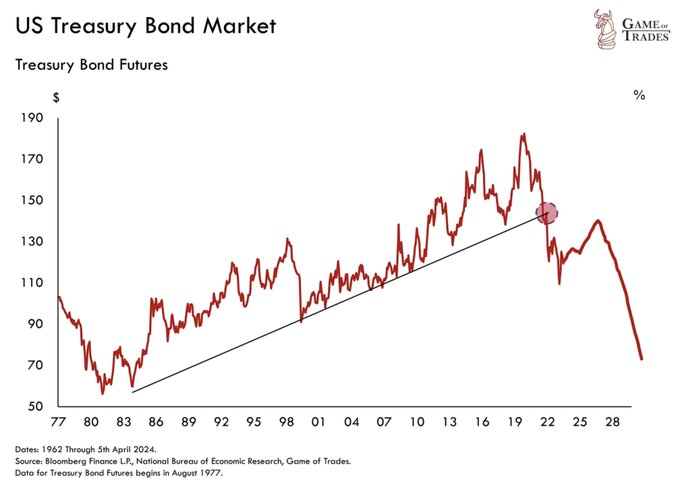

In an X (formerly Twitter) publication on May 3, the platform suggested that the economy faces a bleak outlook, based primarily on the trajectory of US government debt markets, indicating that it appears to be collapsing.

“The collapse of the US government debt market has begun. This has MASSIVE implications for the economy,” the platform noted.

According to the analysis, US government bonds broke a 40-year bullish trend, sending prices down to levels not seen since 2013. This unprecedented decline, one of the most vicious bear markets since the 1980s, caused significant losses to investors, especially those heavily invested in Treasury bonds.

The yield of gold

Adding fuel to the fire is the outperformance of gold, which is up a staggering 170% since March 2020, eclipsing the performance of Treasuries. The rise in gold prices comes amid soaring government spending, with spending soaring from $3.4 trillion to nearly $4 trillion in just two years, according to data provided by the Trades game.

In fact, in recent months, public spending has been the main concern for economists, pointing out that the situation could affect the dollar.

In addition, the platform highlighted the role of increased public spending, financed by higher Treasury bond issuance, as a major factor contributing to potential market turbulence.

Trades game noted that Treasury bond issuance is expected to reach $1.9 trillion by 2024, surpassing levels seen during the financial crisis of 2008. In particular, this item has raised concerns about public debt sustainability.

Workforce involvement

In addition, the researchers pointed to a confluence of factors driving the Treasury bond breakout, including a decline in the labor force participation rate. According to data shared by the entity, the correlation between rising US government debt and declining labor force participation over the past two decades has become increasingly apparent, indicating economic strain as more people retire and less participate in the labor force.

Notably, this comes after the latest US jobs report USA revealed a drop, with employers adding 175,000 jobs last month against expectations for a 243,000 increase.

“One of the key factors driving this long-term breakout in Treasuries is the decline in the labor force participation rate. It has a strong correlation with the rise in US government debt over the past 20 years,” added Game of trade

elsewhere, Trades game noted that the aging population of the United States and the impending retirement of the baby boomers further aggravate the economic challenges, which requires an increase in public spending. However, the analysis raised questions about the likelihood of significant changes in spending habits in the near future, exacerbating concerns about rising public debt.

Safe haven for investors

In light of these developments, attention is now focused on assets likely to protect investors against a possible economic collapse. Researchers have pointed to gold’s recent meteoric rise in this regard.

Experts noted that while gold may find resistance in the short term, lingering problems affecting US debt suggest its breakout could have more upside potential.

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When you invest, your capital is at risk.

#U.S #Economic #Apocalypse #Imminent #collapse #public #debt #market #begins